The international luxury hospitality market is booming and is expected to reach a staggering value of $166.41 billion in 2025. And then to surpass $218 billion by 2029. This growth is fed by the rise in travel, business and leisure. It is also fuelled by the rise of affluent travellers and their desire to seek out exclusive experiences, high comfort, and highly personalized services. In response to the growth of this luxury segment, some hotel groups are tailoring their services-they are creating luxury divisions. The Marriott and Accor Groups are leading the way to a dramatic re-shaping of the top end hotel market sector.

Growth – facts and figures

Market Expansion: By 2030, some forecasts indicate the luxury hospitality market could be worth $238.4 billion.

New Members: Over 300 million new buyers are expected to join the luxury market by 2030, from countries including China, India, Latin America, and Africa.

Continued Growth: Luxury hospitality is expected to grow at an impressive CAGR of 10.5% until 2030.

AI and technology advances: Mobile apps will become a standard in luxury hotels by 2030, greatly augmenting overall customer experience.

Investments: The sector is set to receive colossal investments, amounting to €6 trillion by 2030, underscoring investor confidence in the future of luxury hospitality. Luxury hospitality presents a dynamic, innovative, and highly promising market. These attractive prospects come with challenges, particularly regarding personalization, sustainability, and technology integration.

Major hotel groups target the luxury sector

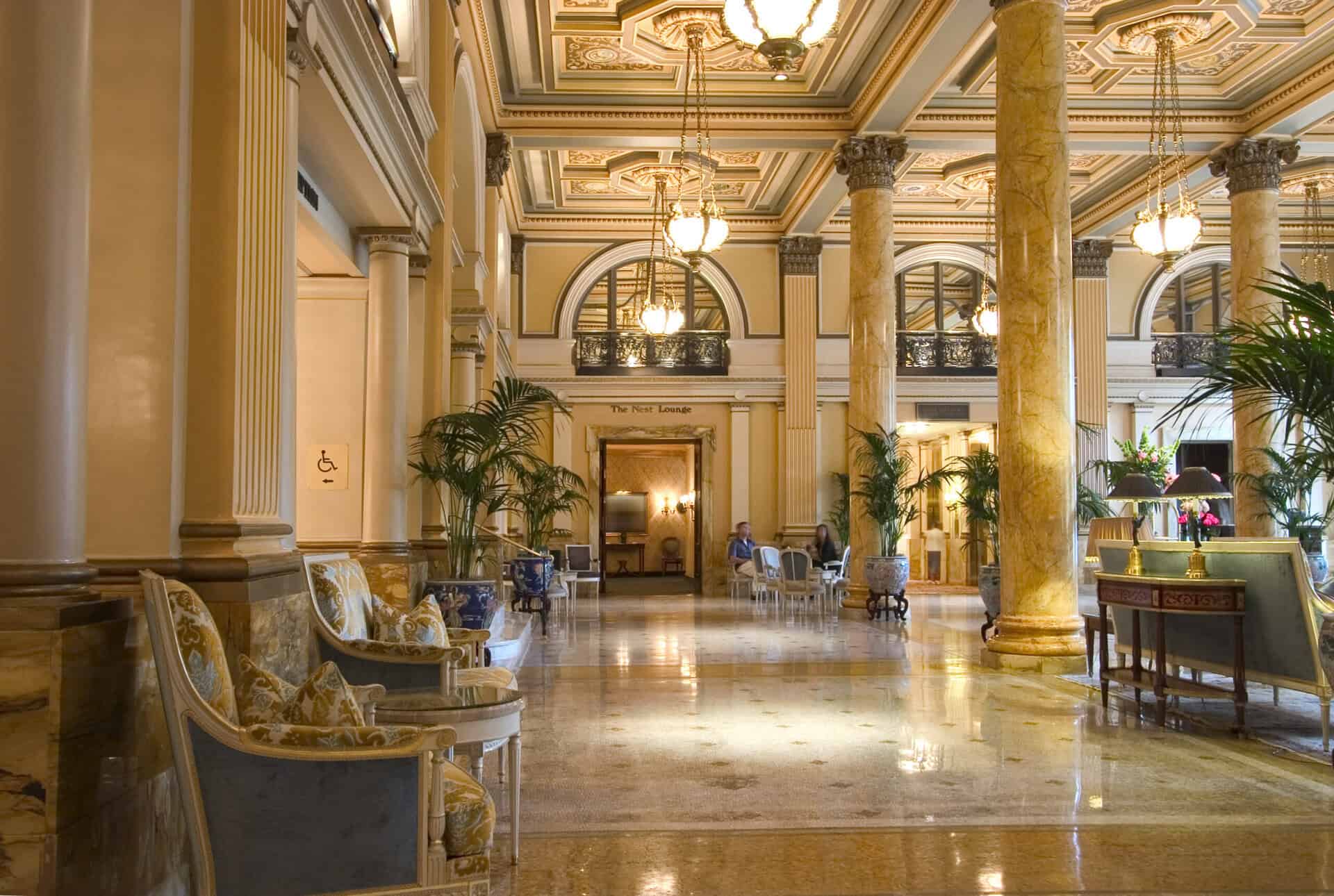

Marriot Int’l dominates the luxury sector currently, with prestigious brands like Ritz Carlton and St Regis. Hilton is planning to open over 500 luxury properties in strategic high-potential destinations, including the reopening of the iconic Waldorf Astoria after its meticulous restoration, combining original Art Deco architecture with contemporary design. The Waldorf Astoria in New York reopened in July 2025 after an eight-year, approximately $2 billion restoration. The historic Art Deco hotel transformed into a luxury destination. Hotel room numbers were reduced from 1,400 to 375 and 372 private residences were built. The structure and public spaces were also restored.

In addition to the large global hotel brands boutique groups like Mandarin Oriental, Shangri-La and Rosewood which focus on exclusive and culturally rich venues.

Current trends in luxury hotel offering

Sustainability – sustainability continues to be a key focus and is becoming embedded in the culture of this market sector. The demand for eco-friendly travel and accommodation is driven by consumers and travellers who are demanding the change. In a recent survey by booking.com, 82% of travellers worldwide agreed that sustainable travel is vital. Many ethical travellers and guests are prioritising preservation of the natural world and its wildlife and are keen to play a part in this.

To underscore their firm commitment to sustainability some hotels are working towards green building certifications like LEED (Leadership in Energy and Environmental Design).

Luxury hotels are also focusing on initiatives such as reduction of single use plastics, investment in renewable enery sources like solar and wind power. Other measures include minimising waste and water consumption.

Ultra Luxury – High net worth individuals are raising the bar further with a desire for immersive experiences and personalisation. Their stature is increased with the hire of private luxury villas or apartments within hotel complexes and unique curated tours for the super wealthy.

Experiential hospitality – The hospitality sector is currently undergoing a transformation. This is partly down to the preferences of Gen Z consumers to experience immersive and personal experiences. The luxury hotel sector is also answering the demands of high wealth consumers to satisfy this demand. This experience economy focuses ‘on the sale of memorable experiences, rather than only services or products. In the hospitality industry, this means hotels, resorts, and accommodations creating memories where the memory and the transformation are the product.’

AI – AI is becoming increasingly important in this luxury sector defined by personal experiences and a human feel. It appears that luxury guests want an intimate experience and to feel deeply understood and relevant. This is defined as a ‘get me’ level of personalisation. AI facilitates this. It works by integrating data from loyalty programmes, past stays and real time data into managed services like preferred lighting, room temperature and entertainment preferences.

It produces highly personal data which improves the guest experience and level of comfort desired. It can also help shape suggested itineraries for guests and help transform every touchpoint into a personal journey.

The rise of ‘Bleisure’ – Bleisure has become the definition of a type of travel which mixes business with pleasure. This activity has grown over 25% in the last year according to Forbes. Hotel owners are reacting by designing room types intended for longer stays. This is in response to market demands from business travellers. There is a future explosion of demand from this audience, with expectations of growth in excess of 500% by 2033. This will be fuelled by the trend for business travellers to take their families for extended stays in favourite destinations during and after the business trip.

This is the ultimate trade off for a work/life balance. It allows a luxury experience to be had by both traveller and his/her family, a greater focus on the employee well being post Covid. This new era is probably best defined by John Hazard, MD of Salterra, a luxury hotel brand, part of the Marriott Group.

‘Covid drove a generational change in working patterns and behaviours; with flexible working hours and location becoming the norm, marking a change in work culture that many companies continue to adopt in the post covid world on the basis of both financial benefit and employee wellness and wellbeing. Covid forced the turning point in attitude towards the traditional views of productivity in the workplace. With the boom of applications such as google meet and Microsoft teams and general acceptance of remote meetings; Never before have the lines between the traditional work-day week and social/personal time been so blurred. Design that includes a move away from the traditional hotel lobby and hotel guest room to better facilitate the partial workday and work on the go approach. Salterra offers more outlets for device charging, more natural light, and ergonomic lobby furniture to allow longer comfortable casual work seating.’

Conclusion

With billion pound investments and high net worth spend, it seems no public spaces are more evident of the expansion of AI technology, luxury experiences and sustainability investment than luxury hotels. The rise of individualism is reflected in the readiness of ultra-wealthy guests to pay the ultimate premium for their stay.

Watch this space for the upcoming article about Architectural FX’s involvement in the lighting of the Chancery Rosewood..